As with most aspects of personal finance and investing, the numbers are always changing. Interest rates rise and fall. The stock market vacillates between a bear and a bull. Inflation goes up, and then it comes back down. Home prices, gas prices, food prices, how much you pay in taxes, the overall cost-of-living—you name just about any aspect in the world of finance, and the numbers are constantly going to be shifting.

It behooves you to pay attention to those shifting numbers, especially the ones that change annually due to inflation, since those figures will affect how much you can save for retirement, your tax bracket, and how large you can grow your estate.

The White Coat Investor updates this page multiple times a year to reflect those changing numbers and to give you the most up-to-date information that will inform how you to invest, save, and spend.

These are the annual numbers, updated as of July 25, 2025.

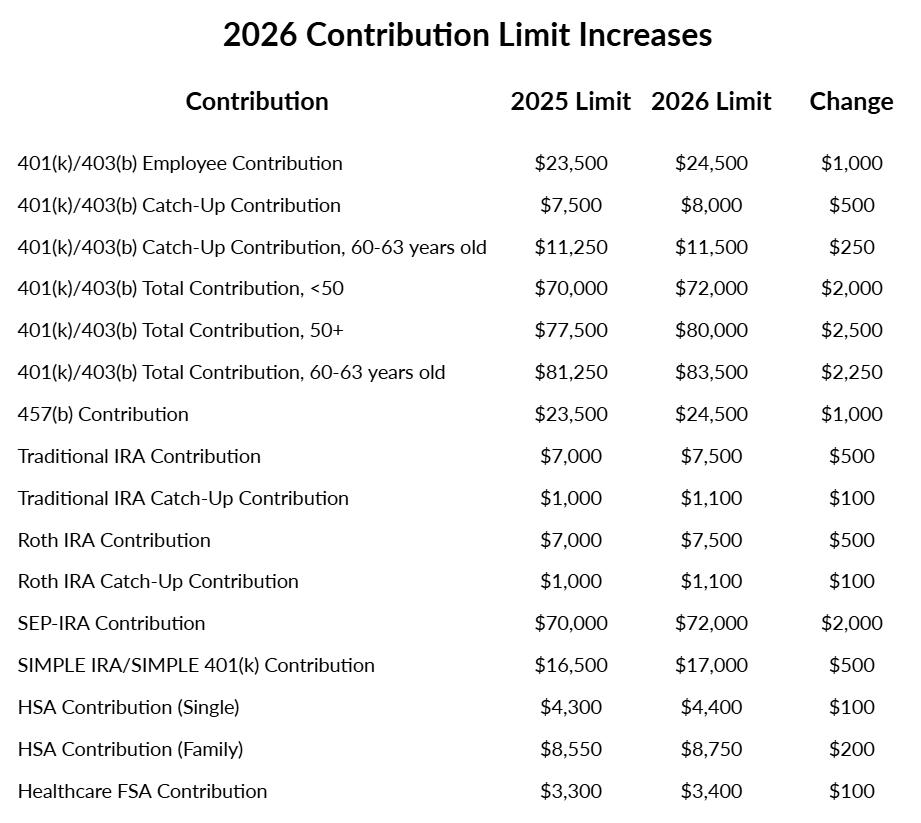

Here are the retirement contribution numbers for 2026, along with how much those numbers changed from 2025 to 2026.

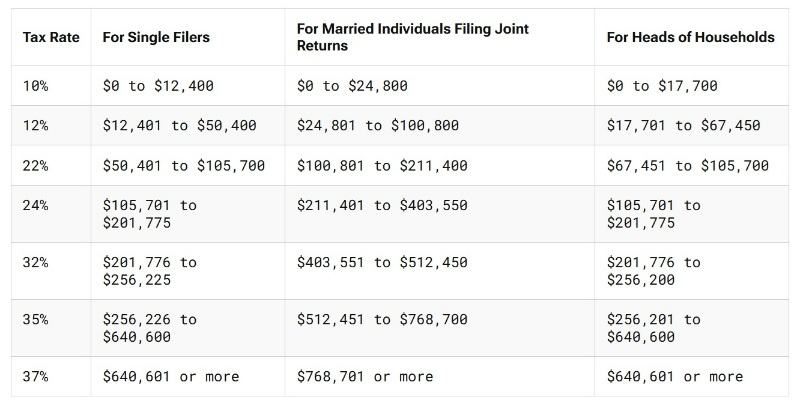

Understanding how your income is taxed and how the tax brackets work will aid your tax planning and make for more informed, reasonable discussions of tax policy.

After Congress passed the One Big Beautiful Bill Act (OBBBA), the standard deduction for the 2025 tax year (which will be due April 15, 2026) was increased. To itemize your deductions, you'd need to have more than the following numbers to make it worthwhile:

If you have an income of less than or equal to the following, your capital gains rate is 0% for 2025.

If your income fits into the following numbers, your capital gains rate is 15% for 2025.

If your income exceeds the limits in the 15% bracket, you'll pay 20% in capital gains.

The IRS also notes other exceptions where your capital gains might be taxed at a higher rate than 20%.

For single people, the HSA contribution limit increased from $4,150 in 2024 to $4,300 in 2025. Family coverage increased from $8,300 to $8,550. The $1,000 catch-up contribution for those 55+ remained the same.

The estate tax exemption for 2025 is $13.99 million for a single person and $27.98 million for a married couple. If your estate is worth more than that, expect the government to tax you heavily.

The gift tax exclusion for 2025 is $19,000. That means you can give away $19,000 to an individual and not have it count against your estate tax exemption. As an example, you could give $19,000 to your two children and their two spouses, equaling $76,000, without it counting against your estate. Your spouse could then do the same, meaning you could give away $152,000 as a married couple and still not have to worry about any tax complications from those gifts.

High-income earners don't have to pay Social Security taxes on all of their earnings. For 2025, the Social Security tax cap is $176,100. Anything earned above that number is not taxed for Social Security, although all of your earnings still will be taxed for Medicare.

While parents can get a $2,200 tax credit for each child they have, many high-income earners will be phased out of taking advantage of that benefit. For 2025, the phaseout begins at the following limits

If you earn more than that, the credit amount is decreased by $50 for every $1,000 above your income cap.

The kiddie tax puts a limit on how much unearned income can be put into a UGMA or UTMA account without anybody having to pay taxes. Some of the income is tax-free, some of the income is taxed at the minor's tax rate, and the rest is taxed at the parent's rate. The tax paid for by the income taxed at the parent's rate is unaffectionately called the “kiddie tax.”

In 2025, the first $1,350 of unearned income for a child is taxed at 0%. The next $1,350 of unearned income for a child is taxed at their tax bracket (generally 0% for qualified dividends and long-term capital gains and 10% for other income). Thus, the “kiddie tax threshold” in 2025 is $2,700.