Ditch the spreadsheets and go beyond savings and investments with Boldin financial planning software. Empower yourself as a DIY investor to take control of all the variables that impact your wealth, retirement timing, and long-term financial security.

Get Started for Free

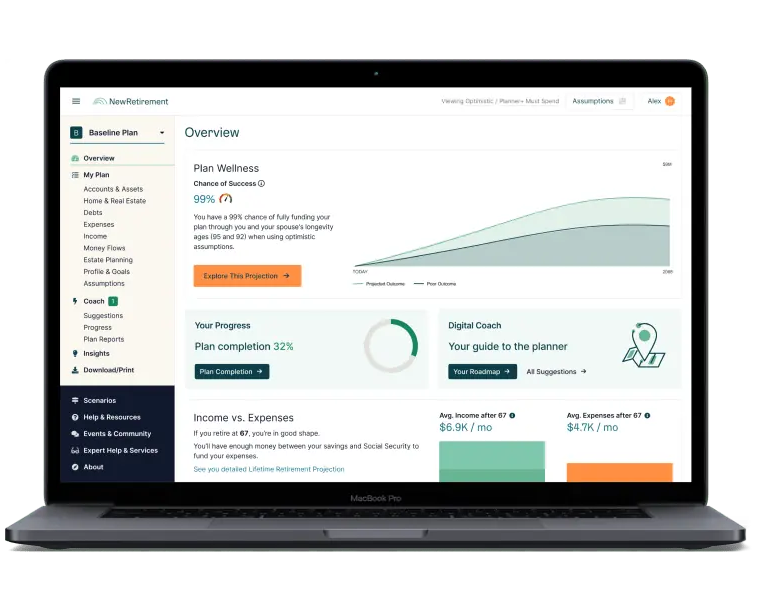

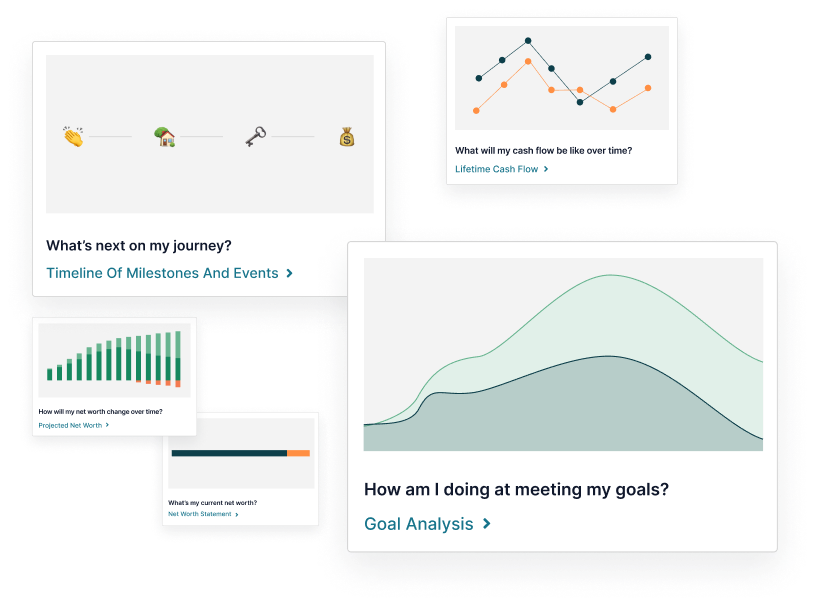

Using the Boldin planning software, you will organize all of your finances in one place, and you'll have the insights, support, and resources to navigate little decisions, big life changes, and the unexpected things that pop up along the way.

The White Coat Investor has partnered with Boldin to bring you the ultimate financial planning software designed with high-income do-it-yourself investors in mind. This robust, easy-to-use tool is much more than a retirement calculator, and it enables you to do better with your money, time, taxes, housing, insurance, and much more.

Get Started for Free

While the Boldin software is very easy to use, it's not a simple retirement calculator. Although its financial planning software will absolutely help you plan for when you can retire, it goes far beyond your savings and investing. Because there is a lot that goes into these calculations, the more data you include, the more accurate the projections and figures.

Like almost anything else with financial planning, you'll get out of this tool just as much as you put into it. If you want a five-minute confirmation that you're doing fine, the Boldin calculator will give you just that. If you want to spend hours and use it to educate you and your partner about many of the ins and outs of financial planning, it will also do that. Modeling scenarios and changing assumptions are its strengths. It is also very useful for tweaking your plan slightly or just updating it every year.

You have the flexibility to input more than 250 pieces of data, allowing you to include various essential details such as:

More powerfully, it allows you to change all kinds of assumptions—but makes it easy by putting in something so you can get started. You start with something reasonable, and then you can change it to see how much your retirement success and income depend on that particular variable.

Some of these changeable assumptions include:

Perhaps most importantly, almost everything allows you to use “optimistic,” “average,” and “pessimistic” assumptions simply by toggling between them.

Yes, Boldin offers a free version which does not require a credit card to sign up. This tier still provides incredible capabilities, including building a personalized financial plan, running “what if” scenarios, Monte Carlo analysis, Social Security Explorer, and Roth Conversion Explorer.

Unlock the full power of this software with more inputs and insights for just $144 a year. Boldin's most popular option, PlannerPlus, is a steal when compared to a financial advisor which would cost you thousands of dollars for something similar. For DIY investors, $144 is a small price that spares you the trouble of starting from scratch and the time you'd otherwise spend creating your own spreadsheets.

Yes, but more powerfully, the Boldin finance planning software allows you to better evaluate your retirement choices so that you can create the best possible plan for your situation. It makes it easy for you to change all kinds of assumptions and even provides a basic starting place from which to work.

You start with something reasonable, and then you can change it to see how much your retirement success and income depend on that particular variable. Some of these changeable assumptions include:

Most importantly, almost everything allows you to use “optimistic,” “average,” and “pessimistic” assumptions simply by toggling between them.